Personal Loan Calculator

Calculate EMI for Personal loans

Powered by dncalculators.com

⚠️Unauthorized copying of this design or any other element is strictly prohibited; otherwise, legal action will be taken.

Personal Loan Calculator – Easily Estimate Your EMI & Interest Costs

When considering a personal loan, understanding your monthly EMI (Equated Monthly Installment) and total repayment amount is crucial for financial planning. A Personal Loan Calculator is a simple and effective tool that helps you instantly estimate your monthly repayments based on your loan amount, interest rate, and tenure. Whether you’re applying through SBI, HDFC, ICICI, or Axis Bank, this calculator can guide your decision with precision and confidence.

What is a Personal Loan Calculator?

A Personal Loan Calculator is an online tool designed to compute the monthly EMIs you need to pay towards your personal loan. It helps you estimate how much your total interest and monthly outflow will be based on key inputs such as:

- Loan amount

- Interest rate (annual)

- Loan tenure (in months or years)

It’s used by individuals to plan their personal loan repayments better, especially when exploring offers from banks like SBI, HDFC, ICICI, Axis Bank, and others.

How Does a Personal Loan Calculator Work?

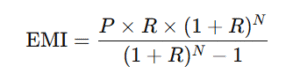

The calculator uses a standard EMI formula:

Where:

- P = Principal loan amount

- R = Monthly interest rate (annual rate / 12 / 100)

- N = Number of monthly installments

Once you enter your values, the tool instantly computes:

- Your monthly EMI

- Total repayment (Principal + Interest)

- Total interest payable

It eliminates the need for manual calculations or spreadsheets.

Benefits of Using This Calculator

Here’s why using a personal loan EMI calculator is beneficial:

- 🧮 Quick and Accurate: No manual math — results in seconds

- 💰 Budget Planning: Know your exact monthly outflow to avoid financial stress

- 🔁 Try Multiple Scenarios: Change tenure or amount and see how it impacts EMI

- 📉 Avoid Over-Borrowing: Know what you can realistically afford

Real-Life Use Cases

- Salaried Professionals

A salaried employee planning a wedding can use the calculator to check if a ₹5 lakh personal loan at 11% interest over 3 years is manageable.

- Medical Emergencies

In urgent health situations, individuals can quickly check EMI affordability and apply instantly for a short-term loan.

- Home Renovation

Couples improving their home can use the calculator to compare offers from HDFC Personal Loan Calculator or ICICI Personal Loan Calculator and pick the most affordable plan.

Tips for Using the Calculator Effectively

- Be Realistic: Enter a loan amount and tenure that aligns with your income

- Check Multiple Banks: Use SBI, HDFC, Axis loan calculators to compare

- Shorter Tenure = Less Interest: Try to repay quickly to reduce total interest

- Factor Processing Fees: Some banks charge additional fees—add those in your budget

Common Mistakes or Myths

- Myth: Lower EMI means better loan

→ Lower EMI may mean longer tenure and higher interest outgo. - Mistake: Not comparing banks

→ Different banks offer different rates. Always compare HDFC, SBI, ICICI, Axis, etc. - Myth: EMI includes everything

→ EMI only includes principal and interest. Processing fees are extra. - Mistake: Ignoring prepayment options

→ Some banks allow part-payment or foreclosure with minimal fees.

How This Tool Saves Time and Improves Accuracy

- Manual calculations take time and are prone to error

- This tool offers bank-grade accuracy instantly

- It helps in comparing offers from various banks like SBI, HDFC, ICICI, Axis Bank, etc.

- With prepayment simulation features, it also helps you visualize savings

It’s not just about EMIs — it’s about making confident, informed borrowing decisions.

Final Thoughts and Next Steps

Before applying for a personal loan, whether from SBI, HDFC, ICICI, Axis Bank or others, always check your monthly outflows with a Personal Loan Calculator. This small step can save you from big surprises later. You can also explore different scenarios, such as changing tenure or trying prepayment strategies, to optimize your repayments.

Next steps:

- Use our free Personal Loan Calculator above

- Compare rates from multiple lenders

- Choose a plan that fits your monthly budget and financial goals

FAQ's

What is a personal loan EMI?

An EMI (Equated Monthly Installment) is a fixed payment amount made by a borrower to repay the loan over time.

How accurate is a personal loan calculator?

The calculator provides near-accurate results based on inputs. Final EMIs may slightly vary depending on bank-specific processing fees.

Can I calculate EMI for any bank?

Yes. You can use this calculator for any bank — including SBI, HDFC, ICICI, Axis Bank, and others.

How does tenure affect my EMI?

Longer tenure lowers EMI but increases total interest. Shorter tenure raises EMI but reduces total cost.

Is there any benefit to prepaying a personal loan?

Yes. Prepayment reduces principal early, helping you save on interest.

Are there calculators with prepayment simulation?

Yes. Some tools offer EMI recalculations with prepayment options. Try a personal loan calculator with prepayment feature if available.

How is interest calculated in a personal loan?

Interest is calculated on the reducing balance method, which means you pay interest only on the outstanding amount.

Is this calculator free to use?

Absolutely! It’s a free tool available for anyone who wants to estimate EMIs accurately and quickly.

📌 Disclaimer:

All calculator tools and content provided on this website are the exclusive property of DN Calculators. We are not affiliated with any bank, financial institution, government body, or any other website. We never ask for money, personal information (such as Aadhaar, PAN, phone number, bank details, etc.), or login credentials from our users. If anyone contacts you claiming to be from DN Calculators and requests such information, please consider it fraudulent and report that person immediately. While we aim to keep all articles, FAQs, and tools accurate and up to date, if you come across any false or misleading claims, please notify us by clicking on “Help Us to Improve”, and we will take corrective action promptly. The results and outputs generated by our calculators are provided for educational, informational, and illustrative purposes only. They should not be construed as investment, medical, or financial advice. Always consult your certified financial advisor, investment planner, or relevant expert before making any decision based on these results.