Mortgage Calculator

Estimate your Mortgage payments

Powered by dncalculators.com

⚠️Unauthorized copying of this design or any other element is strictly prohibited; otherwise, legal action will be taken.

Mortgage Calculator: Plan Your Home Loan with Confidence and Clarity

Buying a home is a milestone in life, but understanding how much you can afford and what your monthly payments will look like can feel overwhelming. That’s where a Mortgage Calculator becomes a must-have tool. It simplifies the process by helping you estimate your monthly mortgage payments based on loan amount, interest rate, loan term, and sometimes even property taxes and insurance.

Whether you’re using a simple mortgage calculator, a bankrate mortgage calculator, or a mortgage calculator with taxes, this tool gives you a clear financial picture so you can plan wisely and borrow smartly.

What is a Mortgage Calculator?

A Mortgage Calculator is an online financial tool designed to help borrowers estimate their monthly mortgage payments. By entering just a few key details — like home price, down payment, loan term, interest rate, and in some cases, property taxes or homeowners insurance — you get a quick breakdown of how much you’ll pay each month.

Many calculators also include options to estimate amortization schedules, taxes, insurance, and even PMI (private mortgage insurance), making them much more than just a basic payment estimator. Whether you’re looking for a mortgage calculator California, mortgage calculator Texas, or a reverse mortgage calculator, this tool adapts to your region and your loan type.

How Does a Mortgage Calculator Work?

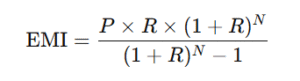

A typical home mortgage calculator uses the following formula to calculate your monthly principal and interest payments:

Where:

- P = Loan principal

- R = Monthly interest rate (annual rate ÷ 12)

- N = Number of total monthly payments (loan term × 12)

Some calculators go further by including:

- Property taxes (estimated as a percentage of the home value)

- Homeowners insurance

- PMI if your down payment is less than 20%

- HOA fees (in some areas)

Advanced tools like the mortgage calculator with taxes or mortgage calculator amortization provide a full picture of your loan cost over time, including how much goes toward interest vs. principal each year.

Benefits of Using a Mortgage Calculator

Using a free mortgage calculator offers several clear advantages:

- Quick and Accurate Estimates – Instantly understand your monthly payment before approaching lenders.

- Financial Clarity – Helps you know what fits within your monthly budget.

- Compare Loan Scenarios – Adjust loan terms, down payments, or rates to see how your EMI changes.

- Supports Smart Decisions – Know whether you should go for a 15-year or 30-year loan.

- Transparency – Understand how taxes and insurance affect your total payments.

- Prequalification Aid – Use estimates to check eligibility and affordability.

Real-Life Use Cases: Who Should Use It and Why?

A mortgage calculator is useful for a wide variety of people:

- First-time homebuyers – Helps them know what they can realistically afford.

- Real estate investors – Evaluate cash flow and ROI for rental properties.

- Homeowners considering refinancing – See how new terms affect payments.

- Retirees exploring reverse mortgages – Use a reverse mortgage calculator to assess equity payouts.

- Buyers relocating to different states – Use region-specific tools like mortgage calculator Texas or mortgage calculator California for tailored results.

This tool helps users avoid financial surprises by allowing them to plan with real-time estimates.

Tips for Using the Calculator Effectively

To get the most from a simple mortgage calculator or an advanced one:

- Enter Realistic Figures – Use actual interest rates and market values from local listings or lenders.

- Include Taxes & Insurance – Use a mortgage calculator with taxes for a full monthly breakdown.

- Try Different Scenarios – Test varying loan tenures, down payments, and rates to see your comfort zone.

- Check Amortization Schedule – Understand how your loan gets paid off over time.

- Use Prepayment Options – If available, check how extra payments can reduce interest.

Using the calculator correctly empowers you with better financial insight.

Common Mistakes or Myths

There are a few misconceptions and errors people commonly make:

- Myth: All calculators give the same result

Not all tools include taxes, insurance, or PMI — results can vary significantly. - Mistake: Ignoring total cost

Focusing only on EMI without checking total interest over the loan term can lead to poor decisions. - Myth: Adjustable-rate mortgages stay fixed

Some buyers assume the starting rate will stay the same — which it won’t in most cases. - Mistake: Underestimating costs in California or Texas

Always use a mortgage calculator California or Texas to account for property taxes, which can vary widely by state.

How This Tool Saves Time or Improves Accuracy

Manual mortgage calculations can be confusing, especially when factoring in amortization, taxes, and other fees. Here’s how the calculator helps:

- Instant Results – No need to create spreadsheets or do manual math.

- Eliminates Guesswork – You know exactly what your monthly commitment looks like.

- Helps Avoid Over-borrowing – Keeps your budget in check before loan application.

- Improves Loan Comparison – Helps you assess deals from different lenders side by side.

- Built-in Accuracy – Ensures you’re using standardized formulas, reducing error.

Whether you’re working with a bankrate mortgage calculator or a localized version, accuracy is just a few clicks away.

Final Thoughts and Next Steps

A Mortgage Calculator is an essential planning tool for anyone looking to purchase or refinance a home. It not only simplifies a complex financial decision but also offers transparency and control over your future loan commitments.

Before applying for a mortgage, take a few minutes to:

- Estimate monthly payments using a calculator

- Factor in all associated costs like taxes and insurance

- Test different interest rates and down payment options

- Use the mortgage calculator amortization feature to see long-term impact

The right calculator — whether it’s a free mortgage calculator, reverse mortgage calculator, or a regional one — is your first step toward a confident homebuying journey.

FAQ's

What is a Mortgage Calculator?

It’s a digital tool that estimates your monthly mortgage payments based on loan amount, interest rate, loan tenure, and sometimes taxes and insurance.

How accurate are mortgage calculators?

They’re highly accurate for estimating principal and interest. For full accuracy, ensure you include estimated taxes, insurance, and PMI if applicable.

What’s the difference between a simple mortgage calculator and an advanced one?

A simple mortgage calculator only includes principal and interest. An advanced version factors in taxes, insurance, amortization, and prepayment options.

Can I use the calculator for any state, like California or Texas?

Yes. Use a mortgage calculator California or mortgage calculator Texas for local property tax estimates, which can differ greatly by location.

How does a mortgage calculator with taxes differ from a basic one?

It includes local property tax and insurance estimates, giving you a more realistic picture of your total monthly outflow.

What is a reverse mortgage calculator?

This tool estimates how much equity you can access from your home in retirement. It’s designed for homeowners aged 62 and older.

How can this tool help me during pre-approval?

It helps you understand what EMI you’re comfortable with, which can guide the pre-approval process and determine your loan eligibility.

Are online calculators really free?

Yes. Most reliable sites offer a free mortgage calculator with no hidden costs or sign-ups, making it accessible to everyone.

📌 Disclaimer:

All calculator tools and content provided on this website are the exclusive property of DN Calculators. We are not affiliated with any bank, financial institution, government body, or any other website. We never ask for money, personal information (such as Aadhaar, PAN, phone number, bank details, etc.), or login credentials from our users. If anyone contacts you claiming to be from DN Calculators and requests such information, please consider it fraudulent and report that person immediately. While we aim to keep all articles, FAQs, and tools accurate and up to date, if you come across any false or misleading claims, please notify us by clicking on “Help Us to Improve”, and we will take corrective action promptly. The results and outputs generated by our calculators are provided for educational, informational, and illustrative purposes only. They should not be construed as investment, medical, or financial advice. Always consult your certified financial advisor, investment planner, or relevant expert before making any decision based on these results.