Home Loan EMI Calculator

Calculate EMI for home loans

Powered by dncalculators.com

⚠️Unauthorized copying of this design or any other element is strictly prohibited; otherwise, legal action will be taken.

Home Loan EMI Calculator: Simplify Your Loan Planning with Confidence

Buying a home is one of the most significant financial decisions you’ll ever make. Whether it’s your first house or a second investment, understanding your monthly repayment obligations is critical. That’s where a Home Loan EMI Calculator becomes an essential tool. It allows you to estimate your Equated Monthly Installment (EMI), helping you plan better, stay financially prepared, and make informed choices before taking a loan.

This article will explain how this calculator works, its benefits, real-life use cases, and practical tips to use it effectively. If you’re comparing options like HDFC home loan EMI calculator, SBI home loan EMI calculator, or even a home loan EMI calculator with prepayment, you’ll find all the insights you need right here.

What is a Home Loan EMI Calculator?

A Home Loan EMI Calculator is an online financial tool that helps you compute your monthly loan repayment amount. By entering three key details — loan amount, interest rate, and loan tenure — the calculator instantly shows how much you need to pay every month.

EMI stands for Equated Monthly Installment, which includes both principal and interest. Whether you’re looking at an ICICI home loan EMI calculator, an Axis Bank home loan EMI calculator, or a general one, they all use the same basic formula to provide fast, accurate results.

How Does a Home Loan EMI Calculator Work?

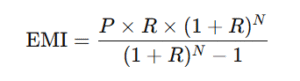

The calculator uses a standard EMI formula:

Where:

- P = Principal loan amount

- R = Monthly interest rate (annual rate divided by 12 x 100)

- N = Loan tenure in months

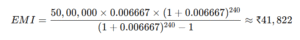

Example:

Loan amount: ₹50,00,000

Interest rate: 8% per annum

Loan tenure: 20 years (240 months)

Monthly interest = 8 / 12 = 0.6667% = 0.006667

The calculator eliminates the need to manually crunch these numbers, offering clarity in seconds.

Benefits of Using This Calculator

Here’s why using a home loan EMI calculator makes financial sense:

- Instant calculations – Saves time with quick, real-time results

- Accuracy – Removes the chance of human error in complex formulas

- Informed decisions – Allows better planning of budgets before applying for a loan

- Compare lenders – Helps you evaluate EMI differences between banks like HDFC, SBI, ICICI, and Axis Bank

- Customizable – Lets you adjust loan amount, interest rate, or tenure to suit your needs

- Prepayment options – Some tools include advanced features for prepayment analysis

Real-Life Use Cases: Who Should Use It and Why?

This calculator is useful for a wide range of users:

- First-time home buyers – Understand affordability and budget management

- Real estate investors – Analyze EMI for different property values and banks

- Working professionals – Plan EMIs around monthly income and other obligations

- Loan comparison seekers – Compare offers from banks using HDFC, SBI, ICICI, or Axis EMI calculators

- Existing borrowers – Use a home loan EMI calculator with prepayment to see how early repayment reduces interest

It’s especially important in India’s dynamic home loan market, where interest rates and offers vary frequently.

Tips for Using the Calculator Effectively

To make the most of this tool:

- Use accurate values – Enter the exact loan amount, interest rate, and tenure

- Check different scenarios – Modify tenure or rate to see the impact on EMI

- Evaluate total interest – Some calculators also show total interest payable

- Look at amortization schedule – Understand the yearly breakup of principal and interest

- Use with prepayment feature – See how extra payments lower total outflow

If you’re using a SBI home loan EMI calculator or Axis Bank EMI tool, verify if they support prepayment inputs too.

Common Mistakes or Myths

Some common misconceptions or errors users make:

- Myth: Lower EMI is always better

Lower EMIs usually mean longer tenure, which can increase total interest paid. - Mistake: Ignoring processing fees

Most EMI calculators exclude bank charges or insurance costs. - Myth: Fixed rates never change

Fixed rates can still change after a few years in some banks; check the fine print. - Mistake: Not updating interest rates

Always use the latest bank interest rates to get accurate EMI figures.

Understanding these issues helps you avoid costly miscalculations.

How This Tool Saves Time or Improves Accuracy

Manual EMI calculations are time-consuming and error-prone. This tool:

- Automates complex math – Provides answers in seconds

- Reduces guesswork – Offers clarity and precision

- Supports financial planning – Aligns EMI with income and future expenses

- Improves lender comparison – Try different interest rates and tenures across banks instantly

If you’re evaluating a loan, this calculator becomes your financial sidekick.

Final Thoughts and Next Steps

The Home Loan EMI Calculator is more than a convenience—it’s a crucial part of responsible home financing. Whether you’re using the HDFC home loan EMI calculator, exploring the ICICI or Axis Bank tools, or trying one with a prepayment option, the outcome is the same: smarter planning.

Before applying for a loan, use this tool to:

- Estimate your EMI

- Assess affordability

- Compare different banks

- Strategize prepayments

Smart use of this calculator means less stress, better decisions, and more control over your financial future.

FAQ's

What is a Home Loan EMI?

An EMI (Equated Monthly Installment) is the fixed amount you pay every month towards repaying your home loan, including both principal and interest.

How accurate is the home loan EMI calculator?

The calculator is highly accurate if you input the correct data, such as loan amount, interest rate, and tenure. However, it doesn’t account for fluctuating interest rates or bank-specific charges.

Can I use the calculator for prepayment analysis?

Yes, some calculators allow you to include prepayments. A home loan EMI calculator with prepayment helps you see how lump-sum payments reduce your loan burden.

Is there a difference between SBI and HDFC home loan EMI calculators?

Functionally, no. All bank calculators use the same EMI formula. The only difference may be the interest rate or added features each bank provides.

Does the EMI change if the interest rate changes?

Yes, in floating-rate loans, your EMI or tenure may adjust when the interest rate changes. Always check the bank’s policy.

Can I use the calculator for joint home loans?

Yes, the EMI calculator can be used for joint loans too. Just enter the combined loan amount and other relevant details.

What is the benefit of using ICICI or Axis Bank EMI calculators?

These calculators may offer added features like amortization schedules, prepayment impact, and even eligibility checks, tailored to their own loan products.

How can I lower my home loan EMI?

You can reduce EMI by opting for a longer tenure, making prepayments, or negotiating a lower interest rate with your lender.

📌 Disclaimer:

All calculator tools and content provided on this website are the exclusive property of DN Calculators. We are not affiliated with any bank, financial institution, government body, or any other website. We never ask for money, personal information (such as Aadhaar, PAN, phone number, bank details, etc.), or login credentials from our users. If anyone contacts you claiming to be from DN Calculators and requests such information, please consider it fraudulent and report that person immediately. While we aim to keep all articles, FAQs, and tools accurate and up to date, if you come across any false or misleading claims, please notify us by clicking on “Help Us to Improve”, and we will take corrective action promptly. The results and outputs generated by our calculators are provided for educational, informational, and illustrative purposes only. They should not be construed as investment, medical, or financial advice. Always consult your certified financial advisor, investment planner, or relevant expert before making any decision based on these results.