Future Value Calculator

Calculate Future value of investments

Powered by dncalculators.com

⚠️Unauthorized copying of this design or any other element is strictly prohibited; otherwise, legal action will be taken.

Future Value Calculator – Plan Your Financial Future with Confidence

Understanding how your investments grow over time is crucial when planning for long-term goals like retirement, education, or wealth creation. A Future Value Calculator is a powerful tool that helps you estimate how much your current investments will be worth in the future. Whether you’re investing through SIPs, fixed deposits, or retirement plans like 401(k), knowing the future value of your assets can guide smarter financial decisions.

This tool is especially useful for individuals in India looking for future value calculator India options, as well as global users calculating returns while considering inflation or withdrawals.

What is a Future Value Calculator?

A Future Value Calculator is a financial tool used to estimate the value of an investment or series of cash flows at a specific point in the future. It considers factors like the principal amount, rate of return, time period, compounding frequency, and, in some cases, inflation or regular withdrawals.

For example, if you invest ₹10,000 today in a scheme that yields 10% annually, the calculator tells you what that amount will be worth in 10, 20, or 30 years.

There are multiple variants like the SIP Future Value Calculator, which is useful for monthly investment planning, and the 401k future value calculator, ideal for retirement planning in the U.S.

How Does a Future Value Calculator Work?

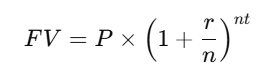

The calculator uses the formula:

Where:

- FV = Future Value

- P = Present value or initial investment

- r = Annual interest rate (in decimal)

- n = Number of compounding periods per year

- t = Number of years

Some calculators also allow customization for:

- Monthly SIP investments

- Inflation rate adjustment

- Annual withdrawals

For instance, a future value calculator with inflation subtracts the inflation rate from the return rate to show a “real value” of your investment.

Benefits of Using a Future Value Calculator

Using this calculator offers several key advantages:

- Goal-based planning: Know how much to invest to reach a financial target

- Retirement forecasting: Estimate corpus using a future value calculator retirement

- Investment comparison: Compare different investment options based on their future returns

- Informed decisions: Understand the impact of compounding and inflation

- Customizable scenarios: Adjust for withdrawals, contribution frequency, or inflation

For Indian users, a future value calculator India can be used to project SIP or FD returns based on local interest rates and inflation.

Real-Life Use Cases

Here are practical examples of who can use this tool and why:

- Young professionals: Plan long-term wealth through monthly SIPs using a sip future value calculator

- Parents: Estimate the future cost of children’s education and start saving accordingly

- Retirees and pre-retirees: Use a future value calculator with withdrawals to model their retirement plan sustainability

- NRIs: Calculate value of Indian investments while living abroad

- Entrepreneurs: Project the value of business investments over time

Additionally, financial advisors often rely on this calculator to help clients visualize the benefit of early and consistent investing.

Tips for Using the Calculator Effectively

To get the most accurate results, consider the following tips:

- Use realistic interest rates: Overestimating can lead to incorrect assumptions

- Include inflation: Always use a future value calculator with inflation to get real purchasing power

- Set clear timelines: The longer the time horizon, the more impact compounding has

- Choose correct compounding: Annual, semi-annual, or monthly based on investment type

- Try multiple scenarios: Explore different SIP amounts or return rates for better comparison

If you’re using a 401k future value calculator, include employer contributions for accuracy.

Common Mistakes or Myths

Avoid these common mistakes while using the tool:

- Ignoring inflation: This leads to an overestimated future value

- Assuming fixed returns: Investment returns vary; use average historical returns as a guide

- Entering incorrect time periods: A small typo can significantly alter your result

- Overlooking withdrawals: Regular deductions impact final corpus

- Using nominal instead of real rates: This can distort expectations

Understanding the assumptions behind your calculator ensures better financial planning.

How This Tool Saves Time and Improves Accuracy

Manual calculations involving compounding, especially with periodic investments or withdrawals, are time-consuming and error-prone. A Future Value Calculator streamlines this by:

- Providing instant, reliable results

- Allowing for multiple customizations

- Minimizing errors with clear formula-based outcomes

- Saving time when creating investment plans or presentations

- Supporting decision-making through comparisons and simulations

Whether it’s a future value calculator retirement plan or SIP growth estimation, this tool is a must-have for anyone serious about their finances.

Final Thoughts and Next Steps

A Future Value Calculator is an essential tool for every investor—beginner or seasoned. It not only helps you set financial goals but also shows you how your money grows over time. By accounting for inflation, returns, and even withdrawals, it provides a more realistic picture of your financial future.

Now that you understand its power, start using a reliable future value calculator India or global version to model your investments. The earlier you begin, the more time your money has to grow through compounding.

Use this tool regularly to track your financial progress and adjust your investment strategy accordingly.

FAQ's

What is a future value calculator?

It’s a tool that estimates the future worth of an investment based on time, rate of return, and compounding frequency.

Can I use a future value calculator for SIPs?

Yes, a SIP future value calculator helps estimate the value of monthly investments over time.

Is the future value affected by inflation?

Yes. Using a future value calculator with inflation gives a more accurate picture by showing purchasing power.

How is it different from a present value calculator?

Future value estimates the worth of money in the future, while present value tells you what future money is worth today.

Can this calculator handle withdrawals?

Yes, a future value calculator with withdrawals allows you to include regular deductions to estimate the remaining value.

How accurate is the calculator?

It’s accurate based on the data you provide. However, market returns can vary, so it’s a projection, not a guarantee.

What’s a good rate to assume for returns?

Historically, long-term stock market returns are 10–12%, but it’s safer to assume 7–8% for conservative planning.

Is there a version for 401(k) planning?

Yes, a 401k future value calculator is tailored for U.S. retirement plans, including employer match and tax benefits.

📌 Disclaimer:

All calculator tools and content provided on this website are the exclusive property of DN Calculators. We are not affiliated with any bank, financial institution, government body, or any other website. We never ask for money, personal information (such as Aadhaar, PAN, phone number, bank details, etc.), or login credentials from our users. If anyone contacts you claiming to be from DN Calculators and requests such information, please consider it fraudulent and report that person immediately. While we aim to keep all articles, FAQs, and tools accurate and up to date, if you come across any false or misleading claims, please notify us by clicking on “Help Us to Improve”, and we will take corrective action promptly. The results and outputs generated by our calculators are provided for educational, informational, and illustrative purposes only. They should not be construed as investment, medical, or financial advice. Always consult your certified financial advisor, investment planner, or relevant expert before making any decision based on these results.