CAGR Calculator

Calculate Compound Annual Growth Rate

Powered by dncalculators.com

⚠️Unauthorized copying of this design or any other element is strictly prohibited; otherwise, legal action will be taken.

CAGR Calculator: Measure Investment Growth with Consistent Accuracy

When evaluating the performance of an investment over time, the CAGR Calculator (Compound Annual Growth Rate Calculator) is one of the most reliable tools. It simplifies the complex growth pattern of investments into a single annual rate, making it easier to compare and analyze returns across different time frames and financial instruments.

Whether you’re an investor, financial analyst, or someone planning long-term goals, understanding how your money grows is essential. The CAGR calculator helps break it down in a way that is easy to understand and act upon.

What is a CAGR Calculator?

A CAGR Calculator is an online financial tool used to determine the Compound Annual Growth Rate of an investment over a specific period. CAGR represents the smoothed annual rate at which an investment grows from its beginning value to its ending value, assuming the profits are reinvested each year.

It’s especially useful when investment returns vary across different years but you want to understand the overall consistent annual return.

How Does a CAGR Calculator Work?

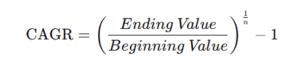

The calculator uses a straightforward formula to compute the compound annual growth rate:

CAGR Formula

Where:

- Ending Value = The value of the investment at the end of the period

- Beginning Value = The value at the start

- n = Number of years

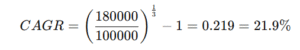

Example:

If you invested ₹1,00,000 and it grew to ₹1,80,000 over 3 years, the CAGR would be:

The CAGR Calculator automates this formula, giving you instant, accurate results by simply entering your starting value, ending value, and time period.

Benefits of Using This Calculator

Using a CAGR calculator offers multiple advantages:

- Simplified Returns: It provides a single rate to describe multi-year growth, even with fluctuating returns.

- Standardized Comparison: Easily compare different investment options or asset classes using one uniform metric.

- Goal Tracking: Helps track whether your investment portfolio is on track for your financial objectives.

- Decision-Making Aid: Compare funds, stocks, or other financial products based on actual performance.

- Investor Confidence: Offers clarity and trust in assessing performance across time frames.

Real-Life Use Cases: Who Should Use It and Why

The CAGR calculator is helpful for a variety of users:

- Retail Investors: Analyze growth in mutual funds, stocks, or gold investments over 3, 5, or 10 years.

- Financial Advisors: Illustrate investment strategies and performance comparisons to clients.

- Business Owners: Calculate annual growth in revenue, sales, or customer base.

- Students or Analysts: Understand how a company’s valuation or profit grows over time.

Whether you’re exploring what is CAGR or want to apply the CAGR formula to real assets, this tool makes the process effortless.

Tips for Using the Calculator Effectively

To get the best out of your CAGR calculations:

- Always use the same currency: Ensure both beginning and ending values are in the same currency.

- Use accurate time frames: Even a few months’ difference can affect the result significantly.

- Exclude outliers: For long-term CAGR, avoid years of unusually high or low returns unless relevant.

- Compare CAGR with benchmark returns: Use it to evaluate if you’re outperforming or underperforming the market.

- Don’t confuse CAGR with average return: CAGR accounts for compounding; average return doesn’t.

Common Mistakes or Myths

Many users misunderstand how CAGR works. Here are a few common issues:

- Myth: CAGR shows actual returns every year

CAGR is a hypothetical constant rate; real returns likely vary year to year. - Mistake: Using it for short-term investments

CAGR works best for investments with at least 3 years of history. - Myth: Higher CAGR always means better investment

Risk, liquidity, and volatility also matter. CAGR doesn’t reflect those. - Mistake: Ignoring interim cash flows

CAGR doesn’t consider periodic investments or withdrawals, unlike IRR.

Understanding these limitations helps in interpreting results more wisely.

How This Tool Saves Time or Improves Accuracy

Instead of manually computing complex exponential formulas, this calculator:

- Automates calculations with precision

- Reduces human error in manual math

- Offers instant results that are easy to read and compare

- Improves decision-making by summarizing performance into a single metric

For example, if you’re comparing two mutual funds over five years, the CAGR calculator lets you instantly determine which fund grew faster on a compounded basis.

Final Thoughts and Next Steps

A CAGR Calculator is a valuable resource for anyone looking to evaluate the consistent performance of investments or business metrics over time. It’s easy to use, time-saving, and presents complex calculations in a simple format.

Understanding CAGR meaning and applying the CAGR formula gives you a clearer picture of your financial growth. Whether you’re managing a portfolio or assessing a company’s sales trajectory, this tool adds clarity and confidence to your analysis.

Start using the calculator today to make smarter, more informed investment decisions.

FAQ's

What is the full form of CAGR?

CAGR stands for Compound Annual Growth Rate, a measure of investment growth over time with annual compounding.

How is CAGR different from average annual return?

CAGR accounts for compounding and assumes steady growth, while average return simply sums yearly returns and divides by the number of years.

Can I use the CAGR calculator for SIPs?

No. CAGR is ideal for lump sum investments. SIPs need XIRR (Extended Internal Rate of Return) for accurate results.

What is a good CAGR for mutual funds?

A CAGR of 10–15% is considered good for equity mutual funds over the long term in the Indian market.

How accurate is the CAGR calculator?

It is accurate as long as you enter the correct beginning value, ending value, and duration. It uses a standard mathematical formula.

What are the limitations of CAGR?

CAGR doesn’t account for market volatility, cash inflows/outflows, or irregular investments.

Where can I apply CAGR in business analysis?

CAGR is used to track annual growth in revenue, sales, customer base, or company valuation over time.

How to calculate CAGR manually?

📌 Disclaimer:

All calculator tools and content provided on this website are the exclusive property of DN Calculators. We are not affiliated with any bank, financial institution, government body, or any other website. We never ask for money, personal information (such as Aadhaar, PAN, phone number, bank details, etc.), or login credentials from our users. If anyone contacts you claiming to be from DN Calculators and requests such information, please consider it fraudulent and report that person immediately. While we aim to keep all articles, FAQs, and tools accurate and up to date, if you come across any false or misleading claims, please notify us by clicking on “Help Us to Improve”, and we will take corrective action promptly. The results and outputs generated by our calculators are provided for educational, informational, and illustrative purposes only. They should not be construed as investment, medical, or financial advice. Always consult your certified financial advisor, investment planner, or relevant expert before making any decision based on these results.