401(k) Growth Calculator

Calculate 401(k) retirement plan growth

Powered by dncalculators.com

⚠️Unauthorized copying of this design or any other element is strictly prohibited; otherwise, legal action will be taken.

401(k) Growth Calculator: Plan Your Retirement with Confidence

Planning for retirement is one of the most important financial decisions you’ll ever make. One of the most effective tools to help you forecast your retirement savings is the 401(k) Growth Calculator. This simple yet powerful tool helps you estimate how much your 401(k) will grow over time based on your current contributions, employer match, expected return rate, and time horizon.

Whether you’re early in your career or approaching retirement, understanding how your retirement savings can grow is critical. This calculator makes it easier to set goals and stay on track for a financially secure future.

What is a 401(k) Growth Calculator?

A 401(k) Growth Calculator is an online financial tool that estimates how much your 401(k) plan can grow over a certain period. It uses your current balance, contribution rate, expected annual return, and number of years to project the future value of your retirement savings.

The calculator is especially useful for evaluating how different factors—like increasing contributions or delaying retirement—can impact your total savings.

There are variants like the Roth 401(k) growth calculator, which consider after-tax contributions, and tools tailored for traditional pre-tax 401(k) plans.

How Does a 401(k) Growth Calculator Work?

This calculator uses the compound interest formula to project your savings growth over time. It accounts for:

- Initial balance: The current amount in your 401(k)

- Annual contribution: Your yearly savings, including employer match

- Growth rate: Estimated annual return (typically between 5% and 10%)

- Number of years: The time you plan to continue contributing

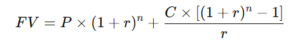

Formula:

Where:

- FV = Future Value of your 401(k)

- P = Initial principal

- r = Annual rate of return (as a decimal)

- n = Number of years

- C = Annual contribution (your contribution + employer match)

The result is a clear projection that helps you answer questions like “How much will my 401k grow by retirement?” or “What is the typical 401k growth rate?” for someone in your situation.

Benefits of Using This Calculator

Here’s why using a 401(k) Growth Calculator is a smart financial move:

- Clarity: It provides a realistic estimate of your future retirement corpus.

- Motivation: Seeing your money grow helps you stay committed to saving.

- Goal-Setting: Helps determine if you’re on track to meet retirement goals.

- Scenario Planning: Allows you to test different contribution levels, timelines, or return rates.

- Tax Insight: In Roth vs. traditional 401(k), you can estimate post-tax vs. pre-tax outcomes.

Whether you’re looking for a 401(k) return rate comparison or just want a visual 401(k) growth chart, the calculator simplifies it all.

Real-Life Use Cases: Who Should Use It and Why

This calculator is useful for:

- Young Professionals: Estimate long-term growth based on current savings and get motivated to start early.

- Mid-Career Employees: Adjust savings strategy if you’re falling behind and test different growth assumptions.

- Near Retirees: Plan final years of contribution and ensure your corpus is enough for post-retirement life.

- HR Departments: Use it as an educational tool to show employees the power of compound growth in 401(k) plans.

Regardless of your age or income, this tool is a valuable resource for planning your financial future.

Tips for Using the Calculator Effectively

To get the most accurate results, follow these tips:

- Be realistic with your expected return rate: A 7% annual return is a common average, but conservative estimates ensure better planning.

- Include employer match: Don’t forget to add your company’s contribution—it’s essentially free money.

- Factor in inflation: While most calculators show nominal growth, think in today’s rupees/dollars for better clarity.

- Review your inputs yearly: As your income or contributions change, update your projections.

- Don’t rely on it alone: Use it alongside budgeting and retirement planning tools for a complete picture.

Common Mistakes or Myths

Avoid these common misunderstandings:

- Myth: My 401(k) grows at a fixed rate

In reality, your 401(k)’s performance depends on market fluctuations, which may impact the average return year over year. - Mistake: Not including employer match

Many users forget to account for company contributions, underestimating growth. - Myth: I can delay contributions and still catch up later

The earlier you start, the more compound growth works in your favor. Time in the market beats timing the market. - Mistake: Ignoring tax impact

Roth 401(k)s are taxed now; traditional 401(k)s are taxed later. This can affect real take-home or spendable amount at retirement.

How This Tool Saves Time or Improves Accuracy

Manually calculating 401(k) projections involves compounding, contribution schedules, and tax considerations. The 401(k) Growth Calculator simplifies this with:

- Quick projections without needing spreadsheets

- Easy comparisons of different growth scenarios

- Visual insights like a 401(k) growth chart to understand trends

- Time-saving interface: Just input your numbers and get answers instantly

It reduces the guesswork and helps you make decisions backed by data.

Final Thoughts and Next Steps

The 401(k) Growth Calculator is more than a number-crunching tool—it’s a strategic companion in your retirement planning journey. With just a few inputs, it paints a realistic picture of your retirement savings trajectory.

By understanding your 401 k growth rate, projecting your 401 k increase over the years, and testing different savings plans, you gain full control over your financial future.

Next step? Use the calculator regularly, adjust your contributions if needed, and revisit your goals annually. Small changes today can mean a financially secure tomorrow.

FAQ's

What is a typical 401(k) growth rate?

A typical long-term growth rate is between 6% to 8% annually, depending on market performance and asset allocation.

Can I use the calculator for a Roth 401(k)?

Yes, many calculators support Roth 401(k) options. You just need to input after-tax contributions instead of pre-tax.

How accurate is the 401(k) Growth Calculator?

It provides a close estimate but not a guarantee. Market volatility, fees, and future inflation can affect actual returns.

What’s the best age to start contributing to a 401(k)?

The earlier, the better. Starting in your 20s allows compound interest to work most effectively over decades.

Does the calculator include employer match?

Yes, you can (and should) include your employer’s annual match for an accurate projection.

How often should I use the calculator?

Once a year is ideal, or whenever your income, contribution rate, or financial goals change.

How much should I contribute to my 401(k)?

At least enough to get the full employer match. Aim for 10–15% of your income if possible.

Can I see my 401(k) growth in a chart format?

Yes, many 401(k) growth calculators include a 401 k growth chart that visualizes your balance over time.

📌 Disclaimer:

All calculator tools and content provided on this website are the exclusive property of DN Calculators. We are not affiliated with any bank, financial institution, government body, or any other website. We never ask for money, personal information (such as Aadhaar, PAN, phone number, bank details, etc.), or login credentials from our users. If anyone contacts you claiming to be from DN Calculators and requests such information, please consider it fraudulent and report that person immediately. While we aim to keep all articles, FAQs, and tools accurate and up to date, if you come across any false or misleading claims, please notify us by clicking on “Help Us to Improve”, and we will take corrective action promptly. The results and outputs generated by our calculators are provided for educational, informational, and illustrative purposes only. They should not be construed as investment, medical, or financial advice. Always consult your certified financial advisor, investment planner, or relevant expert before making any decision based on these results.